Analysis of the prospects of China's magnetic material market: rare earth permanent magnets, permanent magnets, soft magnetic, silicon steel and amorphous (15,000 words)

Release Time: 2023-10-16 Clicks: 29222Introduction

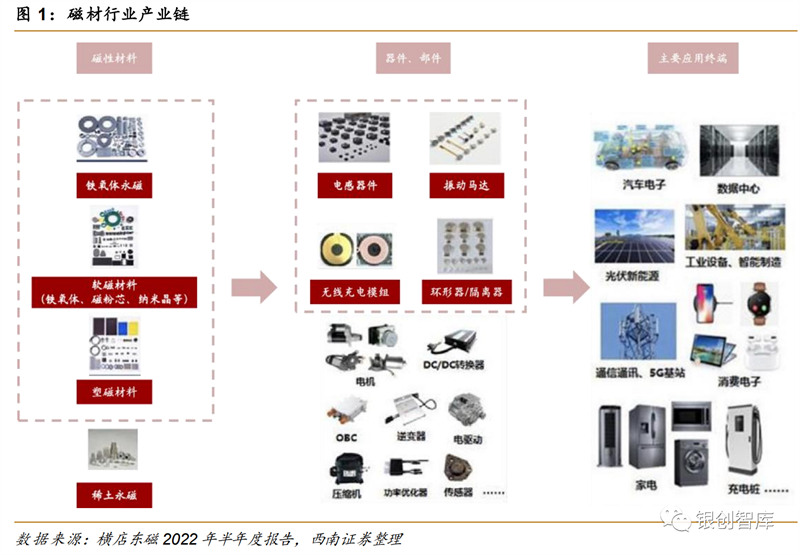

In recent years, the overall demand of the magnetic material industry has risen steadily. The rapid development of light storage, wind power, new energy vehicles, robots, industrial automation, and wireless charging has brought development opportunities to the magnetic material industry.

On the whole, domestic magnetic materials are mostly concentrated in low -end fields, but the international competitiveness of magnetic materials has become increasingly improved, and the gap between R & D level and developed countries has continued to narrow. With my country's economic transformation and upgrading, recovery expectations are good, and with the policy assistance of & ldquo; independent controllable+domestic alternatives & rdquo;, the demand for magnetic material markets is continuously released, and the industry is expected to enter a high -speed development period.

1. The current status of the market for magnetic materials

Magnetic materials refer to substances that can directly or indirect magnetic substances such as iron, cobalt, nickel, and alloys of transitional elements. They are a type of functional materials. They mostly have functions of conversion, transmission, processing, storage information, energy storage, energy storage and other functions. Essence The application of magnetic materials is widely used, covering cars, consumer electronics, wind power, energy, medical, machinery, military, military and other fields.

Compared with developed countries, my country's magnetic material industry started late. Before the 21st century, foreign brands have always occupied the main share of my country's magnetic material market. After entering the 21st century, as technology continues to improve, my country's international competitiveness has international competitiveness. Increased, the gap between the level of R & D and developed countries has continued to narrow. But overall, domestic magnetic materials are mostly concentrated in low -end fields. In recent years, with the transformation and upgrading of my country's economy and the demand for magnetic material markets, my country has also become the world's largest and most vibrant market.

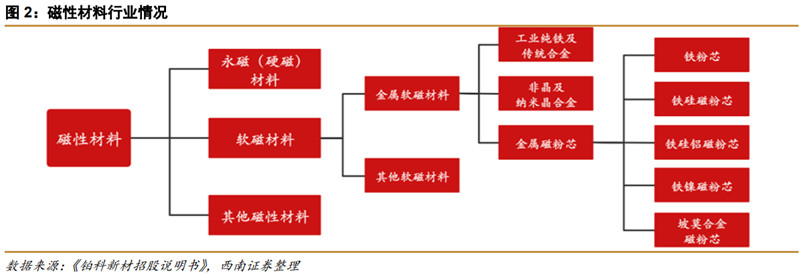

Magnetic material can be divided into permanent magnet (hard magnetic) and soft magnetic materials according to the degree of magnetization after magnetization.

Soft magnetic material is a magnetic material with low stubbornness and high magnetic guidance, which is easy to magnetize and easy to be magnetic. Soft magnetic materials are stubborn between permanent magnet materials and iron oxygen, and magnetism can disappear. Soft magnetic materials have high saturated flux density, high magnetic guidance rate, and the stagnation lines are narrow and long, with small area, small stasis loss, small magnetic and stubborn force. The stagnation loss is small. Compared with iron oxygen soft magnetic materials, metal soft magnetic materials have the characteristics of high resistivity, low magnetic guidance rate, uniform micro -air gap leakage, high temperature stability, and suitable for power inductance design.

Soft magnetic materials are mainly divided into iron oxygen, metal soft magnetic materials and other soft magnetic materials. Due to the long period of development and relatively stable technology, the iron oxygen soft magnetic industry is relatively fierce in market competition. The metal soft magnetic industry is currently in a high -speed development period, and compared with iron oxygen soft magnetic, with the continuous development of downstream photovoltaic inverters, inverter air conditioners, new energy vehicles and charging piles, the industry growth is faster.

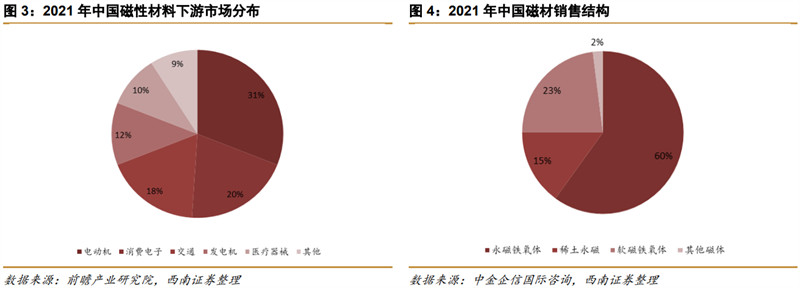

The development of the downstream market has driven the rising amount of magnetic materials. Magnetic materials are widely used, including motors, generators and transportation and medical machinery and consumer electronics. In 2021, electric motor and consumer electronics applications accounted for large, 31%and 20%, respectively. In recent years, the development of new materials, aerospace, marine equipment, high -end equipment, new energy vehicles and other industries have provided vast development for the development of the magnetic material industry. space. Magnetic materials are mainly divided into permanent magnet oxygen, rare earth permanent magnet, soft magnet oxygen body, etc. In 2021, the proportion of permanent magnet oxygen is 60%, which is the largest sales part of the magnetic material. The company's main products are permanent magnet oxygen and soft magnet oxygen.

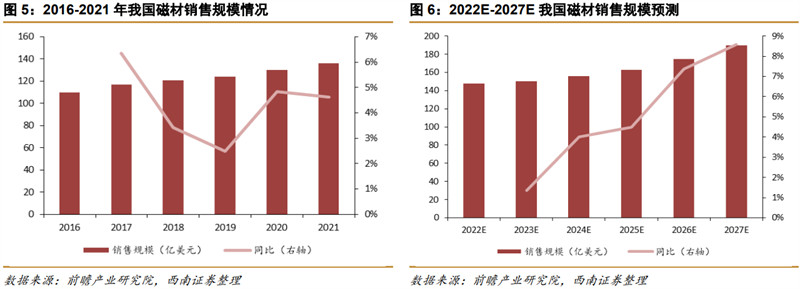

The Chinese magnetic material market has grown steadily, and it is expected that the consumption scale of magnetic materials in 2027 will reach $ 19 billion. According to the data of the Foresight Industry Research Institute, from 2016-2021, the sales scale of magnetic materials continued to increase. In 2021, the sales scale reached US $ 13.6 billion, a year-on-year growth rate of 4.6%. In recent years, the overall demand of the magnetic material industry has risen steadily, and the rapid development of downstream applications such as wind power, new energy vehicles, robots, industrial automation, and wireless charging has brought development opportunities to the magnetic material industry. According to the forecast of the Foresight Industry Institute, the sales scale of China's magnetic material sales from 2022-2027 is CAGR+5.1%, and it is expected that the sales scale of magnetic materials in my country will reach $ 19 billion by 2027.

2. Rare earth permanent magnet

2.1 Supply side: The product structure is king, the customer structure and cost advantage build the moat

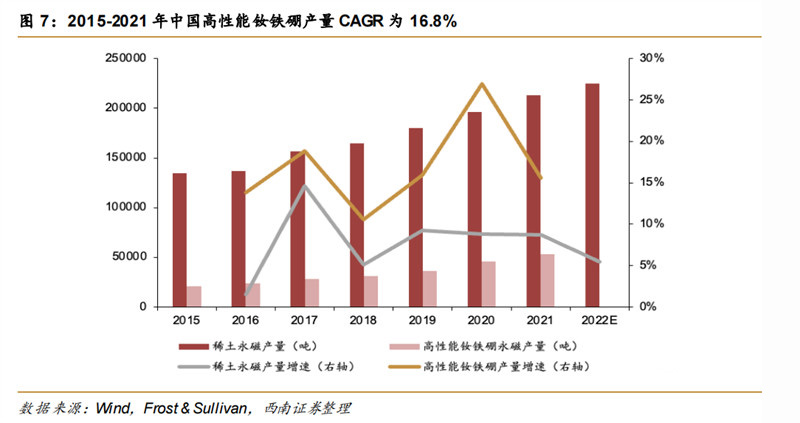

From 2013-2014, 8 domestic permanent magnetic materials companies were authorized by Hitachi metal patent. In July 2014, the patent patent of the iron boron ingredients owned by Hitachi metal expired. From 2015-2021, the domestic high-performance cymbal iron boron output CAGR reached 16.8%, which is much higher than the total output of the rare earth permanent magnet. According to the prediction of the Gongyan.com, my country's rare earth permanent magnet output will reach 225,000 tons in 2022.

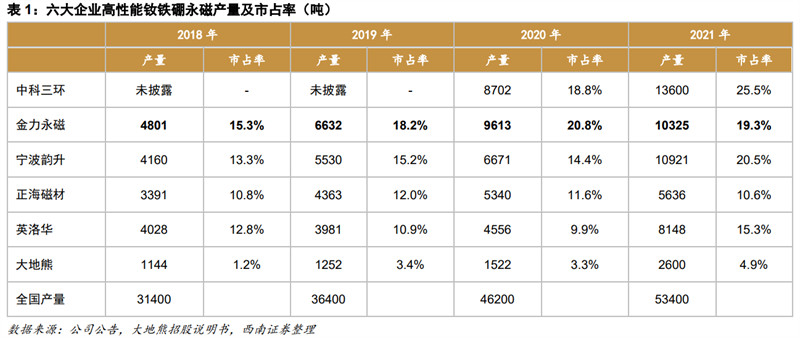

High -tech barriers constitute the industry's moat, and the enterprises that produce high -performance ravioli boron permanent magnet materials have a higher concentration. According to the total output of high -performance tin iron boron in my country in 2021, the total market share of Zhongke Third Ring Ring, Jinli Magnetic Magnetic Materials, Ningbo Yunsheng, Yingluo Hua and Dadi Bear Six Family reached 95.9 %. Due to the high threshold of high -performance tin iron boron production technology, the earliest domestic enterprise in China, which is engaged in the R & D magnetic materials of cymbal iron boron, has the leading advantage. Yuan, the output of the permanent magnet of the tin iron boron is 17,000 tons, which belongs to the leading enterprise in the Chinese cymbal iron boron permanent magnet industry.

After the industry breaks through the technical restrictions of high -performance tin iron boron, the demand volume is superimposed, and many companies have expanded production. According to FROST & AMP; Sullivan, most of the global high -performance 釹 iron boron production capacity is concentrated in China, accounting for about 70%of the world's. In 2021, the national high -performance tin iron boron output reached 53,000 tons, and 6 of the six companies including China Science and Technology Third Ring Road and Jinli Magnetic Magnetic produced a total of about 51,000 tons of high -performance 釹 iron boron (magnetic steel finished product), with a total market share of 95.9%. Among them, the China Science and Technology Third Ring Road has expanded sharply in recent years and is close to full production. In 2021, the domestic market share reached 25.5%, ranking first in China.

2.2 Demand side: The downstream market prosperity exceeds expectations, and the demand for high -end permanent magnets will grow rapidly

The rare earth permanent magnet is divided into sintering and bonding the iron iron boron according to the process. Re -coexist, completely divided in other applications.

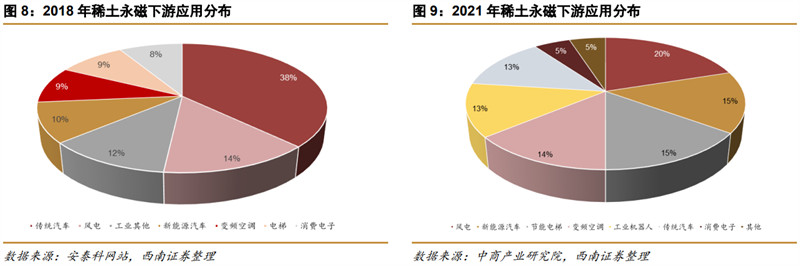

The downstream of the downstream continues, and the demand for rare earth permanent magnets has increased rapidly. Rare earth permanent magnet can transform fossil fuel to renewable energy. According to FROST & Amp; Sullivan, compared with traditional motors, rare earth permanent magnet materials can save up to 15%-20%of energy. According to the China Commercial Industry Research Institute, in 2021 Global Rare Earth Permanent Magnetic downstream demand, wind power and new energy vehicles accounted for 20%and 15%, respectively. Compared with 2018, the two accounted for 14%and 10%, respectively. Essence

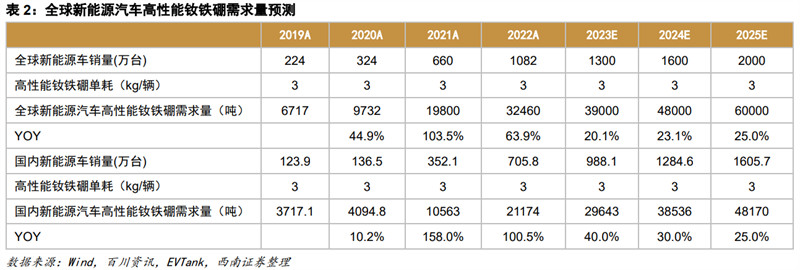

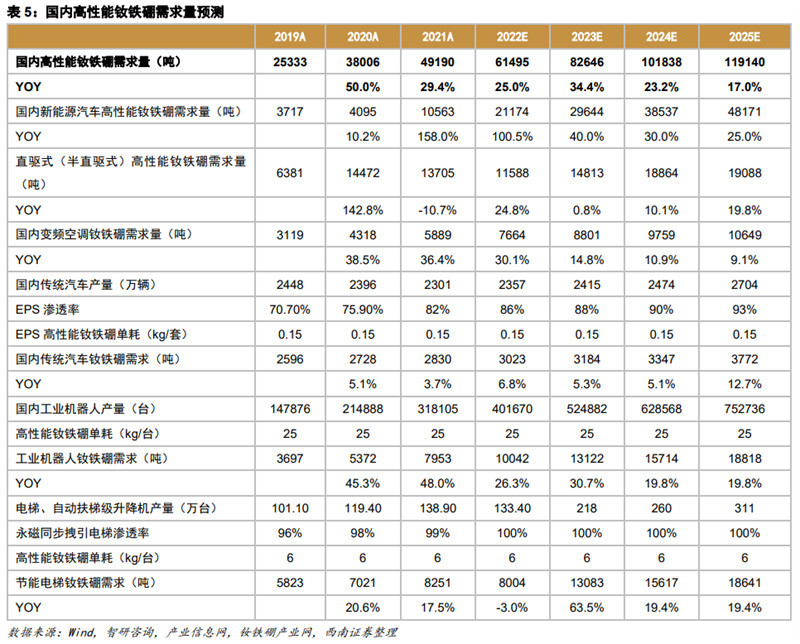

New energy vehicles are the core incremental market in the downstream, which will become the main driving force for the increase in the increase in the consumption of high -performance tin iron boron.According to industrial information, each driver motor needs to use 2.5-3.5kg high-performance tin iron boron. Considering that some electric vehicles use dual motors, we assume that each new energy vehicle consumes an average of 3 KG high-performance Ndfeb, and the calculation will be 2022- In 2025, the global new energy vehicle high -performance Ndfeb magnetic material cost CAGR will reach 31.9%, and the domestic new energy vehicle high -performance tin iron boron dosage CAGR will be 46.1%.

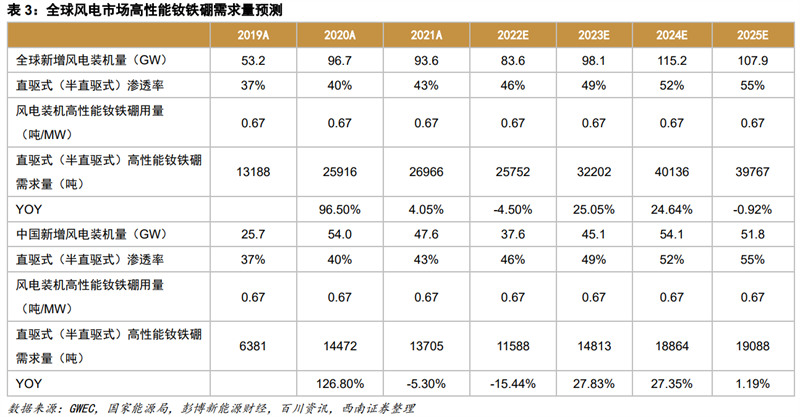

Wind power will still be the main market for high -performance tin iron boron magnetic materials. With the proposal of carbon and targets in various countries in the world, clean energy is more and more valued. Drive -driven permanent magnet and semi -direct -drive permanent magnetic motor has gradually become the mainstream of the market due to its simple installation, low operating costs, and high power, and the growth of high -performance 釹 iron boron demand. According to the industrial information network data, the average 1MW wind power installation requires 0.67 tons of high -performance Ndfeb. We assume that the penetration rate of direct -drive (semi -direct -drive) air motor in the above market has gradually increased to 55%. We calculated that in 2025, the global direct-drive (semi-direct-drive) high-performance Ndfeb demand was 39,767 tons, and 2022-2025 Global wind power high-performance Ndfeb Cagr was 10.2%. In 2025, the demand for high-performance high-performance Ndfeb in China was 19088 tons, and 2022-2025 domestic wind power high-performance Ndfeb CAGR was 8.6%.

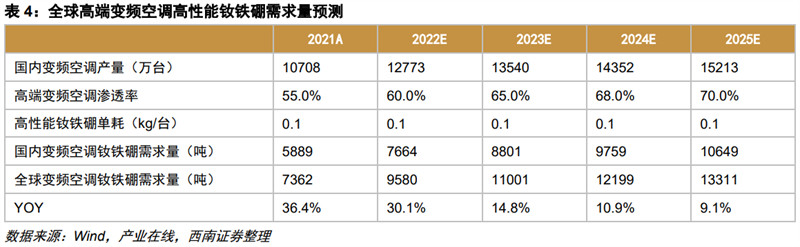

According to the data of the industry online network, a single high -end inverter air -conditioning high -performance Ndfeb volume is about 0.1kg. In 2025, the penetration rate of high -end inverter air conditioners will reach 70%, and domestic air conditioning output accounts for about 80%of the world's. We assume that the penetration rate of high-end inverter air conditioners in 2022-2025 has steadily increased. The amount of high-performance tin iron boron is maintained by 0.1kg/units, and the global proportion of domestic air conditioning production has maintained 80%. Based on this calculation, we expect that the demand for global high-performance Ndfeb in 2023 will exceed 10,000 tons, and 2022-2025 High-end inverter air-conditioning high-performance Ndfeb demand CAGR is 16%.

We calculated that the total CAGR in the domestic high-performance Ndfeb in 2022-2025 was 24.8%. The demand for high -performance tin iron boron has also maintained a speed growth on high -performance Ndfeb demand. According to the data of Zhiyan Consultation, the amount of high -performance tin iron boron in the traditional automobile EPS system is 0.15kg/set, and the EPS penetration rate in 2021 is 82%(calculated by the domestic EPS system sold in 2021). There is still room for improvement in the infiltration rate, and the CAGR of domestic traditional auto tannins from 2023-2025 is 8.9%. According to the Industrial Information Network, an industrial robot consumes about 25kg of high-performance Ndfeb, and calculated that the high-performance tin iron boron dosage of industrial robots in 2023-2025 was 19.8%. According to the data of the Tie Iron Boron Industry Network, a permanent magnet synchronous pulling machine consumes about 6kg of high-performance Ndfeb, and calculated that the high-performance elevator high-performance elevator high-performance Ndfeb dosage of energy-saving elevators in 2023-2025 was 19.4%.

2.3 The permanent magnet industry has expanded rapidly, and the leading enterprise advantages are significant

The planned scale of new production capacity in the industry will be on the stage, and the leading company's head advantage is expected to increase. According to incomplete statistics, a total of 14 new investment projects in the five rare earth permanent magnet companies are being advanced, and the total planned production capacity is close to 100,000 tons. Assuming that all projects are planned as planned, two domestic companies will be more than 20,000 tons/year in China in 2022. It is estimated that the production capacity of Jinli permanent magnets will be overtaken in 2022, and it will reach 40,000 tons/year in 2025.

In addition, from the downstream, there are a number of new projects that clearly focus on & ldquo; new energy vehicles & rdquo; magnetic materials. New energy & ldquo; Circuit & rdquo; With its high -speed growth rate, it has attracted many companies to focus on expanding supporting magnetic steel production capacity.

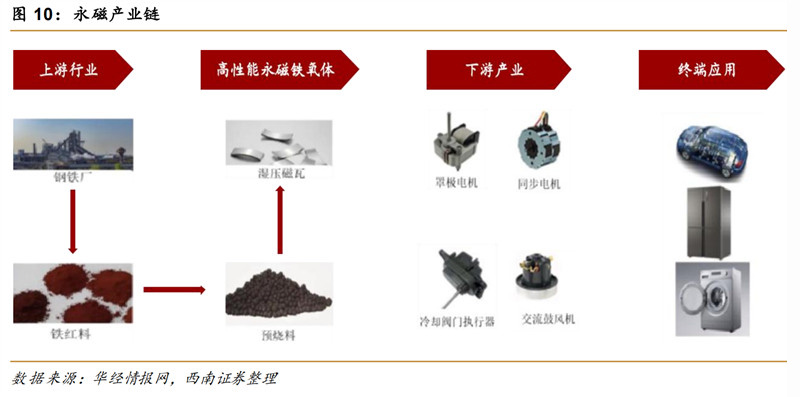

3, iron oxygen permanent magnet

The permanent magnet oxygen, also known as hard magnet oxygen, is a new type of non -metallic magnetic material. The upstream of the permanent magnet oxygen is mainly steel plants, iron red materials and pre -fever. The main products in the downstream are hoods, synchronous motors, cooling valves, and exchange wind turbines. They are mainly used in automotive and home appliance industries.

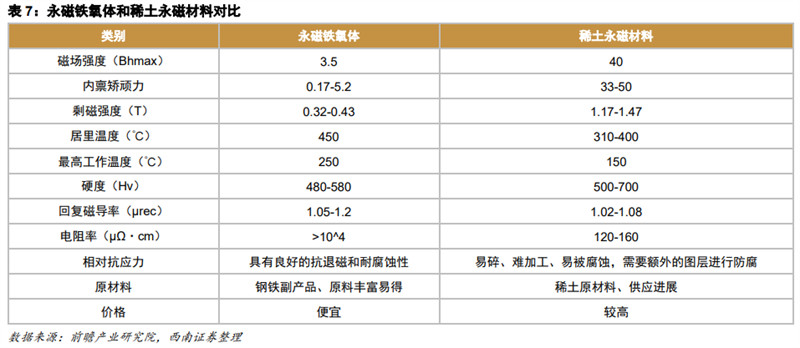

The permanent magnet oxygen is cost -effective and the most widely used . Rare earth magnets and iron oxygen magnets are types of permanent magnets. They are composed of a material. Once this material is magnetic, unless it is damaged, it will maintain many years of magneticity. However, not all permanent magnets are the same. The permanent magnet oxygen can only produce a stable magnetic field with only one magnetic energy to produce a magnetic field, thereby continuously providing magnetic energy to the outside. In addition, the permanent magnet oxygen material is mixed with a small amount of CO, Ni and expensive rare earth elements during the process of ion replacement. Therefore, the cost is greatly reduced compared to the former. The advantages of working environment. Because of this, permanent magnet oxygen is currently the most widely used permanent magnet material, and it has occupied the main position in production and application.

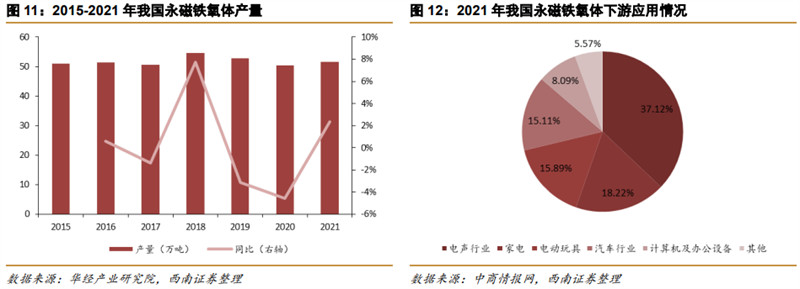

China's permanent magnet oxygen has remained stable, and the downstream is mainly used in the electro -acoustic industry. According to the data of the Huajing Industrial Research Institute, from 2015 to 2021, the output of permanent magnet oxygen was relatively stable, all of which were maintained above 500,000 tons, and the overall presence was presented. The peak value, output was 545,000 tons, and then fell slightly. In 2021, the output reached 516,000 tons, a year -on -year growth rate of 2.4%. The permanent magnet oxygen body is mainly used in the electronics industry, home appliances, and automobiles, and the demand accounted for 37.1%, 18.2%and 15.1%, respectively.

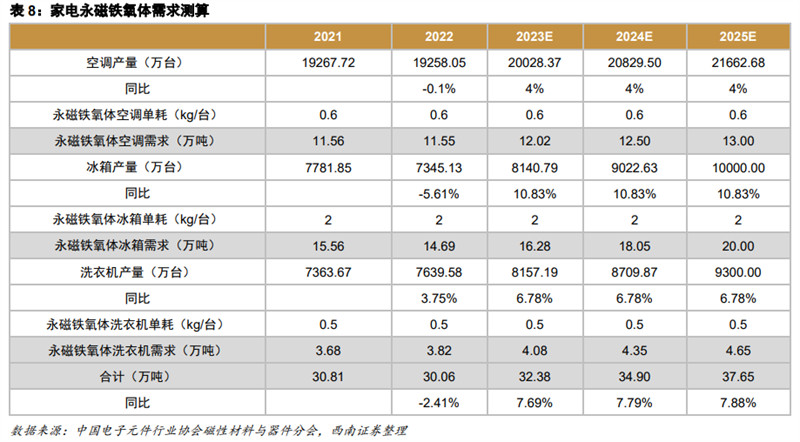

3.1 The production of appliances is steady and rising. It is expected to require Cagr+5.1%

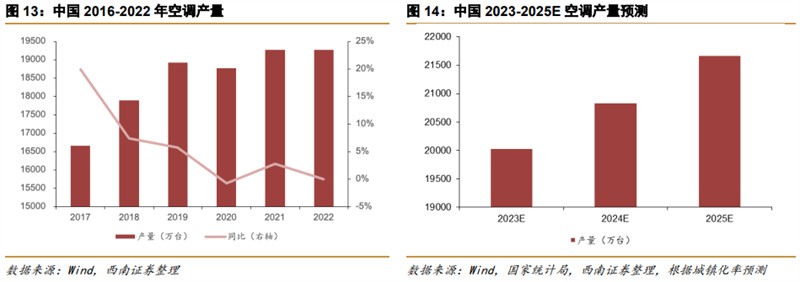

China's air-conditioning output is steadily rising, and it is expected that the air-conditioning production is CAGR+3%from 2022-2025. 2020-2022 The outbreak of the outbreak has declined. As the epidemic is effectively controlled, the enterprise resumes production and production, and it is expected that the output of air conditioning in the future is also ushered in the rise. In 2022, my country's air-conditioning output reached 19.258 million units, a year-on-year decrease of 0.1%. In 2017-2022, the CAGR of the air conditioning production reached 2.9%. In theory, the growth rate of air conditioning production was positively related to urbanization and real estate investment growth. The notice of the 14th Five -Year Plan for the Implementation Plan of the Urbanization of the Fourteen Fourteen, proposed that by 2025, the urbanization rate of the permanent population across the country has steadily increased. We assume that my country's air -conditioning production has increased steadily at a growth rate of 4%, and the output of air conditioning in 2025 reached 21.663 million units.

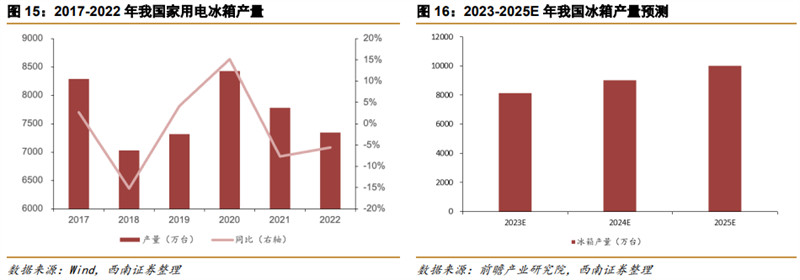

China's refrigerator output has a steady growth rate, and it is expected to be CAGR +6.5%from 2022-2025. After years of promotion and the implementation of policies such as home appliances, my country's refrigerator has a high penetration rate. For refrigerators, consumers have transitioned from products they must buy to alternatives, which has reduced the sales volume of refrigerators. The decline in sales has also continued to decline in production. Since 2018, the output of Chinese home refrigerators has begun to decline. By 2019, the output of Chinese home refrigerators decreased by 73.204 million units. Benefiting from the low base, the output of the refrigerator used in my country in 2020 was 84.261 million units, an increase of 15.1%year-on-year, and the CAGR reached -2.4%in 2017-2022. According to the forecast of the Foresight Industry Research Institute, my country's refrigerator output will reach 100 million units in 2025, and the CAGR will reach 6.5%from 2022-2025.

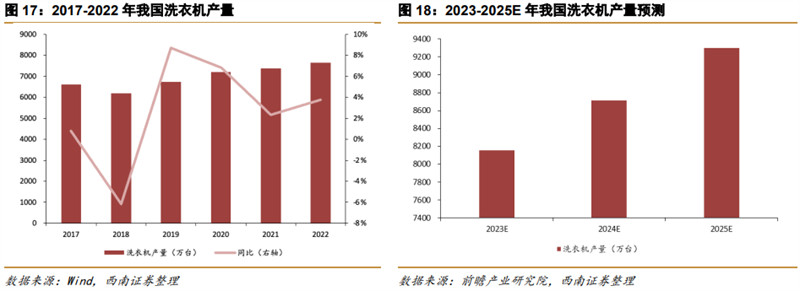

It is estimated that the production of Chinese washing machine production from 2022-2025 is CAGR+6%. After years of development, the Chinese washing machine industry has become a more mature industry. With the implementation of various national stimulating domestic demand policies, the market size has gradually expanded. In 2022, the output of the Chinese home washing machine was 76.396 million units, an increase of 3.7%year-on-year, and 2017-2022 CAGR+3%. According to the forecast of the Foresight Industry Research Institute, the output of my country's washing machines in 2025 will reach 93 million units, and from 2022-2025 CAGR+6%.

The demand for iron oxygen permanent magnet in the home appliance industry 2022-2025 Cagr+5.1%, and the demand in 2025 is nearly 400,000 tons. According to the magnetic material and device branch of the China Electronic Component Industry Association, each air conditioner, refrigerator, and washing machine use permanent magnet oxygen material is 0.6, 2, 0.5kg, respectively. In 2025, the physical demand reached 13, 20, 47,000 tons, and the total demand in the home appliance industry was nearly 400,000 tons, and the CAGR+5.1%was 2022-2025.

3.2 The production of automobiles has risen steadily. It is expected to require Cagr+11.5%

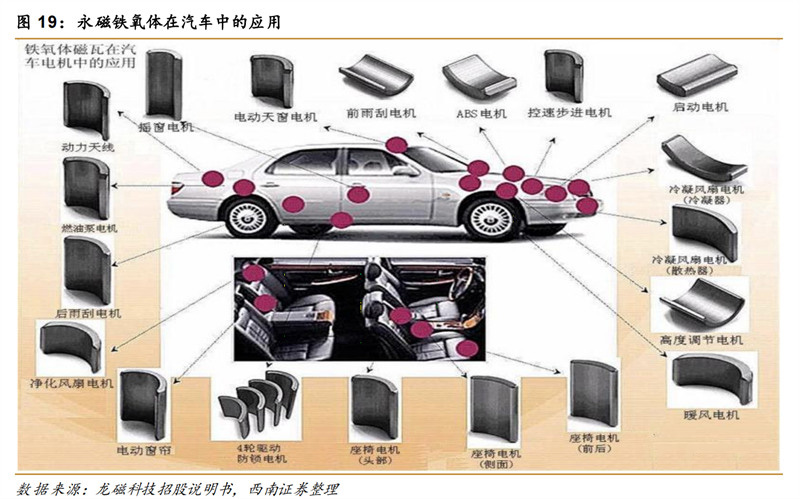

Magnetic tiles are the core components of DC motors. Whether it is traditional cars or new energy vehicles, seat adjustment, shake windows, sunroofs, wiper, air conditioning motors, etc. will use iron oxygen magnetic tiles. There are dozens of motors, most of which have hundreds of motors. With the improvement of the electronic, lightweight, comfort and safety of the car, and the requirements of environmental protection, energy saving, etc., while the electronic parts and electronic devices in the car are increasing With high functional high -efficiency, the more motors you need, and the amount of magnetic tile dosage of cycling.

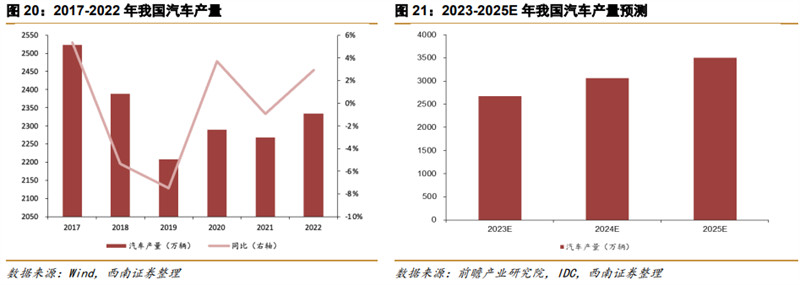

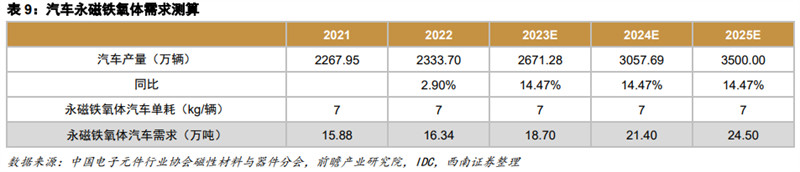

It is expected that my country's automobile output will reach 35 million vehicles in 2025, and the car output CAGR+11.5%will be CAGR+11.5%in 2022-2025. With the continuous growth of my country's total product value and the disposable income of urban and rural residents, the consumption power of residents in my country has continued to increase, which has promoted the consumer demand of Chinese cars. In 2022, automobile output reached 2.3337 million, an increase of 2.9%year -on -year. According to IDC forecast, my country's automobile production will reach 35 million vehicles in 2025, and automobile output CAGR+11.5%in 2022-2025.

The demand for car iron oxygen permanent magnets 2022-2025 Cagr+11.5%, and the demand in 2025 reached 245,000 tons. According to the China Electronic Component Industry Association's magnetic material and device branch, each car uses permanent magnet oxygen material to be 6 ~ 8kg, and we take the intermediate value of 7kg. , 2022-2025 Cagr+11.5%.

4. soft magnetic

The industrial chain of the soft magnetic department has a rich product type. Soft magnetic materials are located in the middle reaches of the industrial chain. The upstream raw materials are simply processed, and then it has provided different types of products with different performances in various industries. The industrial application of soft magnetic materials was first at the end of the 19th century. With the requirements of technological innovation, the iterative update of soft magnetic materials products, and the performance of the material continuously improved. At present, soft magnetic materials mainly include metal soft magnetic, iron oxygen soft magnetic, non -crystal soft magnetic, nanomal There are four types of crystal soft magnetic. Soft magnetic materials are easy to magnetize and easy to degenerate. It has the characteristics of small stasis loss, high magnetic guidance rate, low orthodontic stubborn force, and high saturated magnetic induction strength. It is a key material in the era of electrification and intelligence. Photovoltaic, energy storage, new energy vehicles and charging piles, 5G communication, wireless charging, UPS, inverter air conditioners, rail transit, green lighting and other fields.

In the future, high -frequency, low power consumption and wide temperature and low power consumption are important development directions. High -end consumption and industrial electronics, new energy, cloud computing, Internet of Things, 4G and 5G communication, power supply and other new infrastructure areas and new models Consumer electronics is an important application area. In particular, the rapid development of new energy fields will open the demand space for the application of soft magnetic.

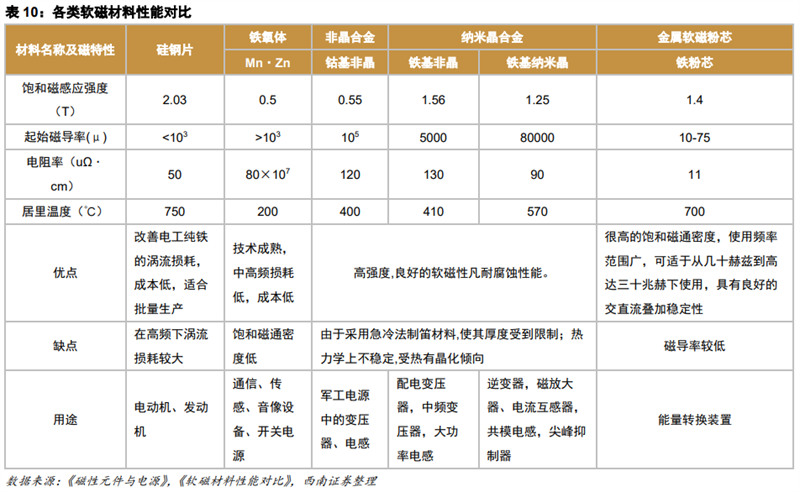

Comparison of the performance of each soft magnetic material: 1) Silicon steel improves the magnetic timeliness by adding a small amount of silicon, and is widely used in electronic devices such as motors, generators and other electronic devices and measuring instruments. The core is to make magnetic materials into powder, add insulating substances between powder particles and use compression to make magnetic cores. It is widely used for energy conversion devices such as photovoltaic inverters and charging piles. The disadvantage is that the magnetic conduct rate is low; 3) Soft magnet oxygen is a series of composite oxide materials containing iron -oxide. The characteristic of the iron oxygen is that the saturated magnetic induction strength is very low, but the magnetic rate and resistivity are very high. Seed inductance iron core; 4) A non -crystal nanocrystal has a high saturated magnetic flux density. It has a wide range of frequency, has good traffic stability stability, has high saturation magnetic flux density, but has low magnetic conductivity. It is widely used in energy conversion in energy conversion. Device.

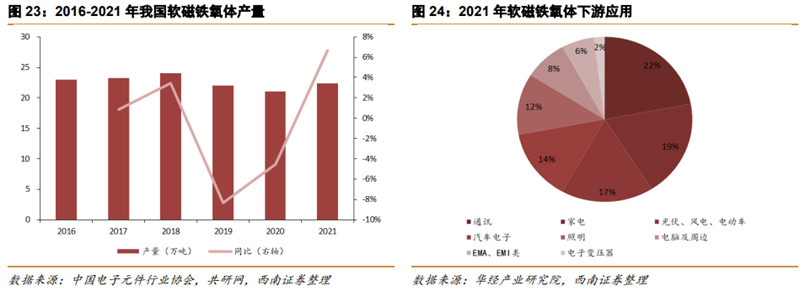

China ’s soft magnet oxygen production has remained stable, and the downstream is mainly used in the communications and home appliance industry. According to the statistics of the China Electronic Component Industry Association, the current production of iron oxygen soft magnetic materials is mainly concentrated in Japan and China. Since 2016-2021, my country's iron oxygen soft magnetic production is generally stable. It accounts for 60%of the global total, and the domestic soft magnet oxygen has an obvious advantage. Soft magnet oxygen body is mainly used in the field of communications industry, home appliances, and new energy, and the demand accounts for 22%, 19%and 17%, respectively.

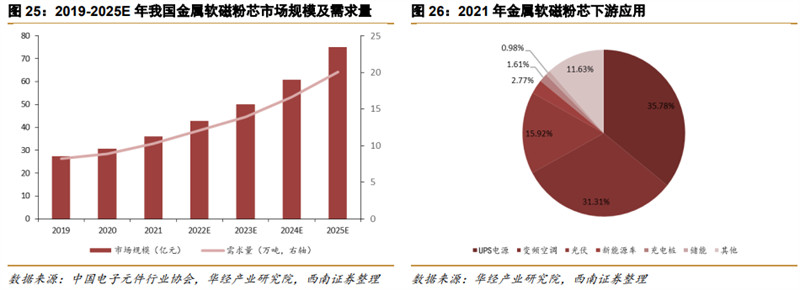

China's metal soft magnetic powder core market has continued to increase, and the downstream is mainly used for UPS power supply and frequency frequency air conditioners. According to the statistics of the China Electronic Component Industry Association, the demand for China's metal soft magnetic powder core in 2021 was 103,000 tons, and the market size was 3.61 billion yuan. It is expected that the demand will reach 201,000 tons by 2025, and the market size will be about 7.52 billion yuan. Metal soft magnetic powder cores are mainly used in the fields of UPS power supply, frequency frequency air conditioners, and photovoltaic. In recent years, with the growth rate of new energy vehicle production growth, metal soft magnetic powder cores are widely used in new energy vehicles and charging pile fields.

4.1 Iron oxygen soft magnetic: stable traditional demand, high -speed growth in emerging fields

Because the epidemic affects the downturn in the field of home appliances and consumer electronics in the traditional downstream home appliances and consumer electronics of soft magnet oxygen, emerging segments such as wireless charging and new energy vehicles have now become the emerging growth momentum of soft magnet oxygen.

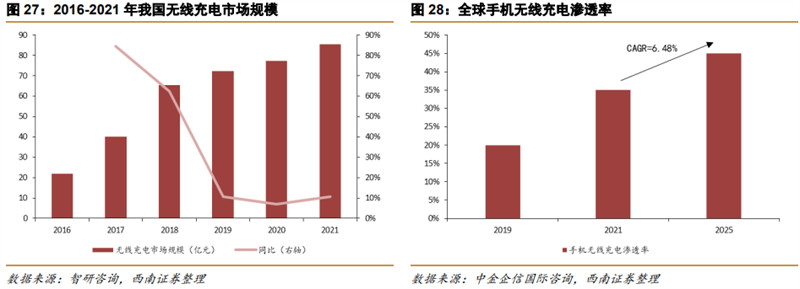

Wireless charging is expected to drive the demand for soft magnet oxygen. The iron oxygen soft magnetic material has the effect of leading magnetic anti -resistance and magnetic shielding in wireless charging. Compared with traditional wired charging, wireless charging has advantages in terms of security, flexibility, and universality. It has broad application prospects in the fields of smartphones, wearable devices, automotive electronics, and household appliances, and the market space is huge. With the continuous breakthrough of the technology bottleneck, the scale of the wireless charging industry has increased year by year. In 2021, the scale of China's wireless charging market reached 8.55 billion yuan, an increase of 10.6%year -on -year.

On the one hand, according to the market research company Report Linker Data, it is expected that the global wireless charging market in 2022 will increase by 27%, from US $ 9.58 billion in 2021 to $ 12.26 billion. The wireless charging market is expected to increase with a compound annual growth rate of 30%in the future, and will reach 34.77 billion US dollars by 2026. On the other hand, the global mobile phone wireless charging penetration rate will increase from 20%in 2019 to 35%in 2021. According to CICC International Consultation predicts that the global mobile phone wireless charging penetration rate will exceed 45%in 2025. It is expected that the high -speed growth of the wireless charging market in the future is expected to drive the demand for soft magnet oxygen.

my country's new energy vehicle production has maintained a faster growth rate, and it will reach 13 million vehicles in 2025. With the rapid growth of my country's automobile ownership, the problems of energy safety and environmental pollution have become increasingly prominent. Vigorously developing new energy vehicles has become an inevitable choice for the current development of the automotive industry. Increase 96%. According to the forecast of the Foresight Industry Research Institute, the output of new energy vehicles in 2025 will reach 13 million vehicles. The rapid development of the new energy vehicle industry has promoted the continuous growth of the demand for electric vehicle power converters.

In 2025, the demand for soft magnetic vehicles in new energy vehicles reached 18,000 tons, and CAGR+23.8%was 2022-2025. Gen According to the research minutes of Hengdian East Magnetic Investor, the amount of soft magnetic dosage of new energy vehicle bicycles is about 0.8-2kg, and the intermediate value is 1.4kg. -Agr+23.8%in 2025.

4.2 Metal soft magnetic powder core: Lighting storage track, continuous demand

From the perspective of the supply side, high -performance soft magnetic metal powder core technology barriers are high, and production shows oligopoly. High cost -effective metal magnetic powder core (iron silicon aluminum and super iron silicon aluminum alloy core), domestic manufacturers have completely replaced international peers; It is mainly occupied by a few manufacturers such as the a few manufacturers such as the aura, the Changxing, the Platinum Kochi New Materials, and the Dongmu Koda. With the development of silicon carbide and nitride technology, there has been room for further enhancement of power electronics to high -frequency development. This puts forward higher requirements for the high -frequency characteristics of metal magnetic powder core. Increasing iron oxygen provides more possibilities. The next -generation high -frequency and low loss metal magnetic powder core is a new growth point of the SMC industry.

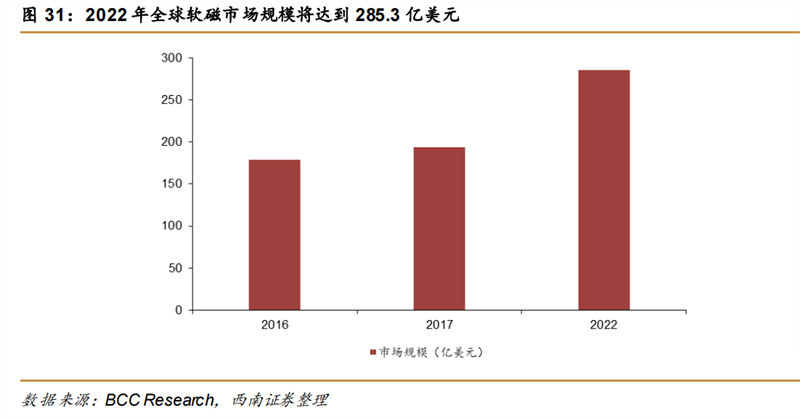

From the perspective of demand, the global soft magnetic material market has grown rapidly. Taking the Chinese soft magnetic material market as an example, according to the data of the China Magnetic Materials and Device Industry Association, the total demand for the Chinese soft magnetic market in 2018 reached 415,000 tons, an increase of 7.3%year -on -year. According to BCC Research, due to the continuous growth of downstream industries such as electronics, telecommunications, and automobiles, the global soft magnetic material market will grow from 8.1%from 2016 to 2022. It is expected that the global soft magnetic market will reach 285.3 in 2022 in 2022. One hundred million U.S. dollars.

Photovoltaic inverter is a power conversion device. The main function is to turn the DC electric inverter generated by solar panels when it is irradiated with solar light to AC power and send it to the power grid, that is, the grid of photovoltaic power generation. As the core device in the photovoltaic power generation system, the market size of the photovoltaic inverter continues to expand with the strong growth of the photovoltaic market, and in the photovoltaic inverter, the unstable DC electricity emitted by the photovoltaic battery plate is boosted into a stable DC In the circuit of the voltage, Boost's boost inductor is its key core magnetic element. After that, the stable DC voltage is converted into a 50Hz sine wave AC power through the inverter circuit. When entering the power grid, it is necessary to use important large large large large. Power AC inversion inductance , the magnetic material of these two inductors components basically uses high -performance iron and silicon core materials. Photovoltaic inverters are mainly divided into centralized, group -stringed, and distribution schemes. The soft magnetic materials used in centralized formulas are mainly silicon steel sheets, and the group string type uses metal soft magnetic powder core.

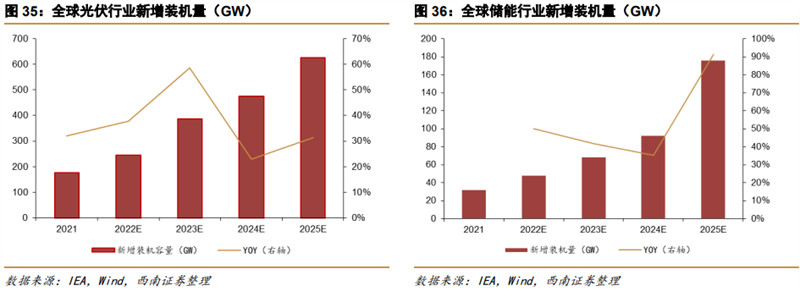

The global photovoltaic new installation has grown rapidly. In 2021, the global photovoltaic new installation machine reached 183GW. Global, photovoltaic and other renewable energy power generation is accelerating replacement of traditional fossil energy and nuclear power. According to BNEF statistics, since 2016, photovoltaic has become the largest power supply in the world. The size of the new photovoltaic installed capacity exceeds the total installed capacity of fossil energy (coal and oil and gas), hydropower and nuclear power. In 2021, the global photovoltaic new installation capacity was 183GW, an increase of 27.0%year -on -year. According to Retink Energy, the global photovoltaic photovoltaic photovoltaic photovoltaic in 2022 The new installation capacity is about 222GW. As the epidemic is controlled globally, especially the major economies will focus on the development of economic recovery and stimulus after the sustainable development formulation and implementation of epidemic, and it is expected that global photovoltaic demand will enter the rapid growth channel.

The penetration rate of the groups of storage in the group is increased, which is expected to drive the demand for metal magnetic powder core. In 2021, the Chinese photovoltaic inverter market still mainly focuses on centralized inverters and group -type inverters, and the distribution inverter market accounts for relatively small. Among them, the proportion of groups rose from 66.5%in 2020 to 69.6%.

The rapid growth of the global optical storage machine has driven the demand for alloy soft magnetic materials. According to IEA forecast, the number of new photovoltaic installations in 2025 is expected to reach 625GW, and the amount of energy storage capacity is expected to reach 176GW.

The demand for soft magnetic demand for light storage inverters 2022-2025 CAGR+43%, 2022-2025 The overall soft magnetic balancing pattern of light storage is used in 2022-2025. According to the data of the Industrial Information Network, the amount of soft magnetic materials per GW alloy is about 200 tons. We expect that the demand for global light storage alloy soft magnetic materials from 2023-2025 is 7.6/9.7/138,000 tons. In concentration, the supply of Platinum New Materials Human Dongmu shares accounted for more than 60%. Other companies: Sinosteel Tianyuan, Dragon Magnetic Technology, and Hengdian East Magnetic have expanded, but the overall increase is limited. The increase in soft magnetic demand for photovoltaics, and the speed of production capacity expansion determines the market share of the enterprise. Dongmu shares will occupy more market share at the faster production capacity expansion rate. The market share in 2023 has increased to 39.5%. Rate is basically at the same level as the new material of Platinum Forence.

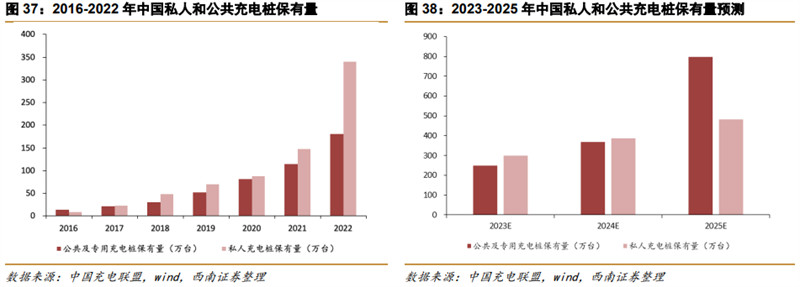

The amount of private and public charging piles in China will reach 5.266 million units in 2025. The charging pile is a device for replenishment energy to new energy vehicles (including pure electricity and plug -in), and charges new energy vehicles of various types according to different voltage levels. my country's new energy vehicle ownership has continued to rise. According to data released by the China Charging Alliance, in 2022, there were 13.1 million new energy vehicles nationwide, 1.8 million units in public and special charging piles in my country, and 3.4 million private charging piles. According to the forecast of the China Charging Alliance, the increase in public and special charging piles/private charging piles in 2025 was 430.9/957,000 units, respectively, with a total increase in charging piles of 5.266 million units.

The demand for charging pile soft magnetic powder cores will reach 07,000 tons in 2025. According to the East Magnetic Investor Investor Investor in Hengdian, the soft magnetic dosage of the charging pile car bicycle is about 0.5-2kg, and the intermediate value is 1.25kg. Cagr+61.6%in 2025.

5, silicon steel and amorphous

5.1 Silicon Steel: Power Grid's investment in the prosperity continues, and the price of high -license -oriented Silicon Steel is strong

In 2021, my country ’s non -obtained dynamic production capacity of electrical steel was 12.53 million tons, an increase of 14.3%year -on -year. In terms of the production of orientation electrical steel, the production technology level and product research and development capabilities have improved significantly, and the production capacity has improved significantly. In 2021, the dynamic production capacity of Electric Irgamotia was 1.95 million tons, an increase of 8.3%year -on -year. In 2021, the output of non -income electric steel was 11.382 million tons, and the output of orientation electric steel was 1.801 million tons. Since 2016, with the promotion of supply -side structural reform policies, my country's steel and steel production capacity has achieved remarkable results, and the optimization of enterprises in the industry has increased the supply of orientation electrical steel products. The utilization rates of non -exalted electrical steel and the capacity of orientation electrical steel reached 90.8%and 92.4%, respectively.

During the period of & ldquo; Thirteenth Five -Year Plan (Thirteenth Five -Year Plan; in the period, my country's electrician steel industry has made significant technological progress, realizing the full coverage of low -end to high -end products, and high -end products account for faster proportion. Among the orientation of silicon steel, the output of high magnetic -oriented Silicon Steel in 2021 was 1.189 million tons, an increase of 28.6%year -on -year. Generally, the output of Silicon Steel in 2021 was 612,000 tons, a year -on -year decrease of 6.1%. In 2021, high magnetic -oriented silicon steel accounted for 66.0%of the total output of Silicon Steel. According to the prediction of the China Metal Society Electric Gang Steel Branch, the proportion of Silicon Steel Silicon Steel in high magnetic sensing in the period of fourteen five & rdquo;

5.1.1 Supply side: Concentrated competition pattern, production capacity in 2024.

The competition in the silicon steel industry is in the relatively concentrated market, the production capacity formation is based on state -owned enterprises, and the rapid development of private enterprises. Due to the high threshold of the industry, high magnetic -oriented Silicon Steel products are mainly state -owned enterprises. Generally, the competitive pattern of Silicon Steel products based on private enterprises will maintain the status quo for a longer period of time.

Silicon steel production capacity is concentrated in 2024. According to the secretary of the Baosteel Investor Exchange Platform, Baosteel plans to increase the capacity of Silicon Steel to 1.16 million tons in 2024, an increase of 260,000 tons from 2021. Shougang shares produced 200,000 tons in 2021. This year, the second phase of the Silicon Steel Steel has begun construction. It is expected to be put into production in 2023. At that time, it will add 90,000 tons of Silicon Steel Silicon Steel Silicon Steel in the ultra -thin specifications. The Tai Steel Stainless High -end Cold Rolling Silicon Silk Steel Silicon Project started construction in November 2019. It is planned to be completed in the second phase. At the end of December 2024, it will be put into operation throughout the line. In terms of private enterprises, the 80,000 tons of high-performance orientation of the Silicon Steel Steel Project has begun to be constructed. Among them, the domestic equipment is expected to be completed within 12 months. At that time, the capacity of 20,000 to 30,000 tons will be added. The import equipment is expected to be in 2024 In June, the production capacity of the year could be increased by 50,000 to 60,000 tons, and all production was reached in 2025. Baotou Weifeng's production capacity of silicon steel was 100,000 tons in 2021. In 2022, the company invested 800 million yuan to build a 100,000 -ton high magnetic -oriented Silicon steel project. It is expected to be put into production in 2024. By then, the company will have 200,000 tons of silicon steel production capacity.

According to our calculations, the total production capacity of Silicon Steel in 2022-2025 is 213, 236, 264, and 2.72 million tons. In 2021, the utilization rate of silicon steel in my country was 92%, and the capacity utilization rate of production capacity in 2022-2025 was 98%, 98%, 99%, and 99%, respectively. Essence

5.1.2 Demand side: The downstream demand is strong, and the supply and demand shows a tight and balanced situation.

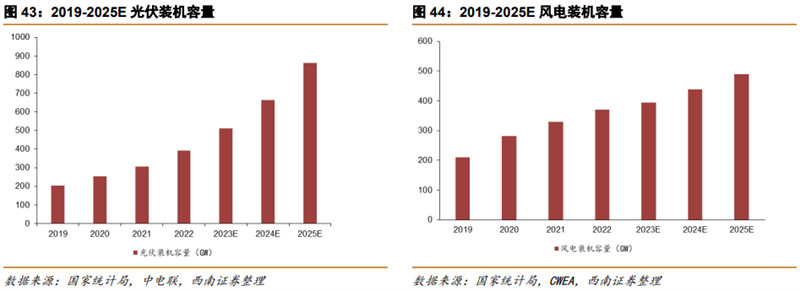

The unique downstream of Silicon Steel is a transformer, and the transformer's transmission and power control equipment industry is closely related to the power industry. In recent years, the development of my country's power industry has provided broad development space for transmission and distribution and control equipment manufacturing enterprises. Power distribution and control equipment are widely used in the fields of power grids, new energy power generation, rail transit, data centers, new infrastructure and other fields, and have good market prospects. According to the latest forecast of the China Photovoltaic Industry Association, my country's photovoltaic installation machine will exceed 800GW in 2025. According to the Forecast of the CWEA Wind Energy Committee, the total capacity of my country's wind power machine in 2025 is expected to be close to 500GW.

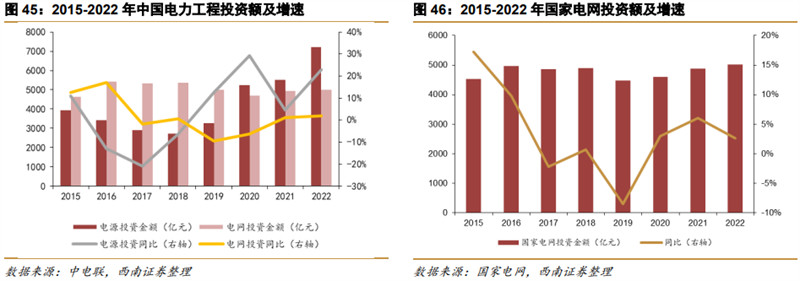

& ldquo; Dual carbon & rdquo; The target is strong constraints, and the construction of power informatization is promoted from top to bottom. In 2022, my country's power investment amount was 720.8 billion yuan, an increase of 22.8%year -on -year; the investment amount of power grid was 501.2 billion yuan, an increase of 2%year -on -year. In 2022, the national power grid investment increased steadily. In 2022, the investment amount of the State Grid reached 501.2 billion yuan, an increase of 13 billion yuan from 2021, an increase of 2.7%year -on -year. According to the latest statement of the Chairman of the State Grid, the planned investment amount of the State Grid in 2023 will exceed 520 billion yuan.

According to the "Value of Silicon Steel and Market Opportunities under the Dual Carbon Strategy", the capacity coefficient corresponding to various power generation methods and the judgment of the entire network converter from the power generation terminal to the power terminal, and the data based on the China Electricity Union and CWEA We make the following predictions: 1) Wind power and photovoltaic are the main incremental increase in the demand for stems of silicon steel, and the growth rate of thermal power has gradually fallen. We predict that the growth rate of the installed capacity of thermal power from 2022-2025 was 3.0%, 3.0%, 2.7%, and 2.5%, respectively. 2) The general design life of the transformer is 30 years, and my country's stock transformer has been in the process of continuous iteration. Based on the output and iteration rate in recent years, & ldquo; fourteen five & rdquo; During the iteration of the existing transformer, the demand for the iteration of the existing transformer was 84,000 tons/year. 3) According to the high growth rate of the export of silicon steel in recent years, we conservative assumptions that the net export volume of silicon steel in 2023-2025 is 10%.

We expect that the demand for silicon steel in my country from 2022-2024 is 193, 239, and 2.78 million tons, respectively.

According to our predictions, from 2022-2024, the supply and demand gap/excess of silicon steel in my country is 15, -7, and -16,000 tons, respectively. From 2023-2024, it is generally in a tight balance.

5.2 A amorphous: New energy efficiency standard drives the proportion of non -crystals, and the user engineering market space is broad

A amorphous alloy, also known as & ldquo; liquid metal, metal glass & rdquo;, is a new type of soft magnetic alloy material, mainly including iron, silicon, boron and other elements. The manufacturing process of its main products of amorphous alloy band is to use rapid cooling technology to quickly cool the alloy fuse at a speed of 106 ° C per second, forming an amorphous alloy thin band with a thickness of about 0.03mm. Sequential amorphous arrangement. Thanks to the special atomic structure formed by the above -mentioned extremist production processes, the amorphous alloys have excellent characteristics such as low -correction, high magnetic conductivity, high resistance rate, high temperature resistance and high toughness. At present, amorphous alloy materials are mainly used in the field of power distribution transformers.

In the early days, due to the low mass production scale and the low technical process maturity, the price was higher than the silicon steel transformer with the same capacity. In recent years, with the continuous maturity of the non -crystal band manufacturing process, domestic enterprises have gradually broken the monopoly position of Hitachi metal in my country's amorphous belt market. With the gradual improvement of the localization rate, market supply has gradually increased. In 2021, the output of Chinese amorphous belt materials was about 103,000 tons, an increase of 6%year -on -year. & nbsp;

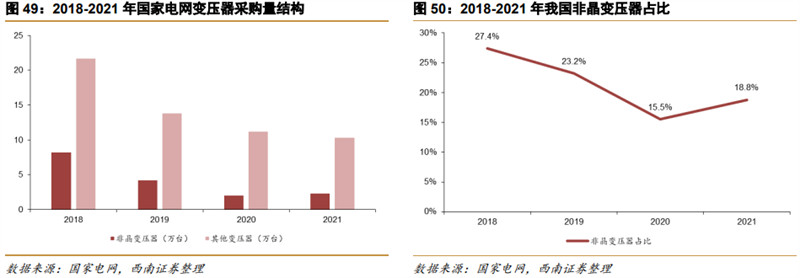

In the field of power distribution, the domestic power distribution transformer market pattern presents a structure with silicon steel transformers and supplemented by amorphous alloy transformers. In 2021, the purchasing volume of the State Grid transformer was 126,000 units, of which 23,000 units of am crystal transformers were 23,000 units, and an amorphous transformer accounted for 18.8%.

With the overall investment of the national power grid distribution network, the overall bidding number of power grid distribution transformers has declined in recent years. The "Power distribution transformer energy efficiency improvement plan (2021-2023)" jointly issued by the Ministry of Industry and Information Technology, the State Administration of Market Supervision and the National Energy Administration in December 2020 requires to accelerate the promotion and application of high-efficiency energy-saving transformers. It is clearly required that the prohibition of non-compliance transformers from accessing the power of the power. Since 2021, 2021 From June, the new procurement transformer should be an efficient energy -saving transformer. By 2023, the proportion of high -efficiency energy -saving transformers will increase by 10%on the Internet, and the proportion of high -efficiency energy -saving transformers will reach more than 75%of the year; High -efficiency energy -saving transformer structure design and processing technology innovation & rdquo;. With the country's & ldquo;, & ldquo; carbon neutralization & rdquo; Overall planning and target determination, the high -efficiency energy -saving transformer manufactured by amorphous alloys and other materials ushered in strategic development opportunities and a broader market space. Essence

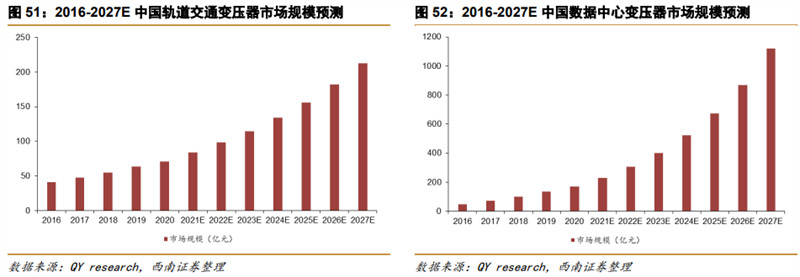

The low -correction, high magnetic guidance rate, and high resistance rate of amorphous alloy thin bands make the material easier to magnetize and degenerate, which can significantly reduce the electromagnetic conversion loss. It is 60%-80%. In the operation scenario of high reliability and low load rates such as rail transit and data centers, energy-saving advantages are more significant. According to Qy Research data, the market size of rail transformers from 2021 to 2027 will remain continuously growing. The market size is expected to exceed 20 billion yuan in 2027; it is expected that the market size of the data center transformer market from 2021 to 2027 will maintain a high -speed growth trend. The market size in 2027 is expected to exceed 110 billion. The high -speed growth data center field is expected to bring an incremental market space to the amorphous alloy transformer.

5.3 Metal powder material: downstream industry prosperity, optimistic about the long -term development of MLCC powder

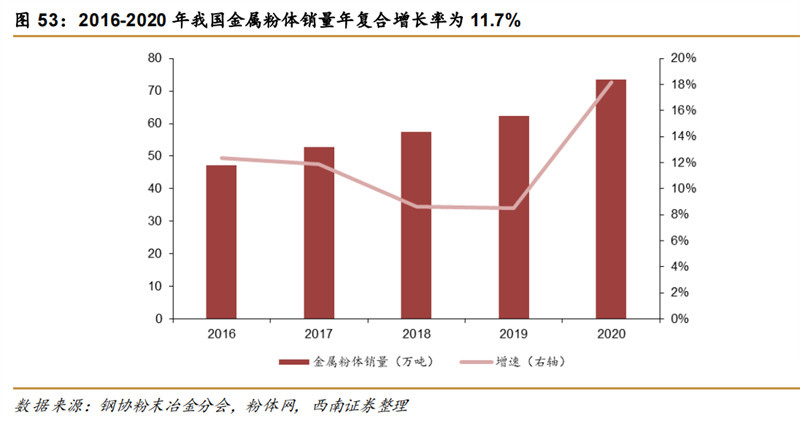

Metal powder refers to metal particles with a size of less than 1mm. Including a single metal powder, alloy powder, and some of the difficult melting compound powder with metallic properties, it is the main raw materials for powder metallurgy and other industries. According to statistics from the Steel Association Powder Metallurgical Branch, according to the sales volume of iron and copper -based powder, the sales of Chinese metal powder increased from 472,000 tons in 2016 to 736,000 tons in 2020, with an average annual compound growth rate of 11.7%. In the future, with the use of metal powder in emerging fields, such as 5G communications and new energy, the size of the Chinese metal powder market is expected to continue to grow.

Compared with ordinary metal powder, electronic high-end metal powder is mainly used to make MLCC (Multi-Layer Cramic Capacitors, chip multi-layer ceramic capacitors). Different from the traditional powder metallurgical material industry, as the electronic component products are becoming smaller and thinner, the pink diameter of the electronic high -end metal powder material industry is much smaller than the traditional powder metallurgical material industry, and there are obvious differences in manufacturing technology and technology.

From the perspective of the supply side, the industry's technical barriers are obvious and there are very few domestic scale. Electronic -specific high -end metal powder industry belongs to emerging industries, and gradually develops with technological innovation and product iteration of the downstream electronic component industry. At present, there are very few companies with large -scale production of MLCC nickel powder. Except for new materials in China, other MLCC production companies are Japanese companies. Metal powder material preparation methods must rely on complex process processes and high equipment investment, no matter what method is to complete, the production process has the characteristics of high technical technical requirements and multi -disciplinary cross -comprehensive integration. In the future, the types and directions of electronic special high -end metal powder will be mainly used in the fields of magnetic material alloy, nickel -based high -temperature alloy, low melting point alloy and other fields.

From the perspective of demand, the global high -end powder prospects are broad. From the perspective of the scale of the MLCC industry, according to the data released by the China Electronic Component Industry Association, the global MLCC market size in 2021 will be 114.8 billion yuan, and it is expected to reach 149 billion yuan by 2025. The CAGR from 2022-2025 is 6.7% of the CAGR will be 6.7%. Essence Under the logic of semiconductor domestic replacement logic, it is expected to continue to drive MLCC powder demand.

6. Related domestic enterprises

6.1 Golden Permanent Magnet: Rare Earth Permanent Magnet, the proportion of high -brand products continues to increase

High -performance rare earth permanent magnet faucet, with a significant advantage. The company's products are widely used in new energy vehicles and automotive components, energy -saving inverter air conditioners, wind power, 3C, industrial energy -saving motor, energy -saving elevators, rail transit and other fields, and have established long -term for long -term domestic and foreign companies in various fields Stable cooperative relationship. In 2021, the company used crystal penetration technology to produce 6064 tons of high -performance rare earth permanent magnet material products, ranking first in the world.

Layout the production base of permanent magnet materials, and the production capacity has been further improved. In the first half of 2022, the company created a complete green industry chain in order to expand the production capacity of existing products and build a comprehensive utilization of rare earth permanent magnet recovery, high -performance rare earth permanent magnet materials, and magnetic components to create a complete green industrial chain, and then laid out high -performance rare earth permanent magnet material projects. At present, the company's rough production capacity is 23,000 tons/year, and the high -performance rare earth permanent magnet material project of 8,000 tons/year in Baotou has reached its production in June. The company's long -term production capacity will reach 40,000 tons/year in 2025.

6.2 Hengdian East Magnetic: Based by magnetic materials, deep cultivation of photovoltaic lithium batteries to create new growth poles

Stable magnetic faucet status, adding new photovoltaic new energy. 1) Magnetic material development, providing customers with one -stop solution. The vertical extension of the company's magnetic material industry, with the help of material development advantages, provides downstream customers with one -stop solution from materials to devices; 2) deeply cultivating the European photovoltaic market and continuously developing product competitiveness. 80%of the company's components are sold to Europe, which is expected to obtain secondary growth bonus in the European market. At the same time, the company has set up Topcon and P-IBC mid-test lines to transform from P-shaped silicon chips to N-type silicon wafers to enhance the company's product competitiveness and brand brand Power; 3) Deeply cultivating the field of lithium battery segmentation. With the release of production capacity, the market share will gradually increase.

The production capacity of magnetic materials is obvious, and it continues to follow up with new photovoltaic new energy production capacity. In 2022, the company launched & ldquo; the annual investment of 15,000 tons of soft magnet oxygen projects & rdquo; and & ldquo; Lili subsidiaries and invested 22,000 tons of permanent magnet oxygen project & rdquo; /Permanent magnet/soft magnetic/plastic magnetic production capacity reaches 22/16.5/5.5/25,000 tons; in November 2022, the company launched & ldquo; annual production of 20GW new high -efficiency battery project & rdquo; It will reach 9/14/15GW; the company's public raised funds are intended to invest in & ldquo; annual output of 6GWH high -performance lithium battery projects & rdquo;, it is expected that the lithium battery production capacity of 22/23/24 will reach 7/8.5/8.5GWh.

6.3 China Steel Tianyuan: Back to Bao Wu to expand permanent magnet oxygen, manganese faucet futures can be expected

The inspection and testing service is the company's current high -quality assets. For more than 20 years, services have gradually covered the fields of infrastructure, chemical industry, environmental protection, housing construction and other fields, and including metal, non -metal, rubber and other categories.

The current proportion of the magnetic material industry accounts for about 50%, and the profit accounts for about 40%. Tons device.

The company is the largest four -nine oxide three -manganese manufacturer in China. The top domestic -ranked metal product inspection and testing agencies, permanent magnet device manufacturers, and ketone products exporters. The current production capacity of tetraoxide three manganese is 55,000 tons; the battery -grade tetraoxide triterior is currently purchased. In early 23 years, it will be put into production by 10,000 tons. The output will reach 65,000 tons in 23 years. The production progress has slowed down and temporarily stabilized at 50,000 tons; in terms of soft magnetic devices, there are currently nearly 20,000 tons of output; permanent magnets are affected by Bao Wu's reorganization, which is very uncertain. 100,000 tons; the initial planning of soft magnets silicon powder was built in 23 years. 4,000 tons were built in 23 years; the magnetic powder core has hundreds of tons of production capacity.

6.4 Dragon Magnetic Technology: Deep cultivation of permanent magnet oxygen body, layout micro -reversal obtaining a second growth curve

The company has long been committed to the research and development of high -performance permanent magnet oxygen wet pressure magnetic tiles. At present, the scale of high -performance permanent magnet oxygen wet pressure magnetic tiles has reached 40,000 tons. The downstream mainly includes car motor and inverter appliance motors. Globally, large -scale companies include Japan's TDK and Hitachi metal. The size of Hitachi metal is about 55,000 tons, and the scale of TDK is about 60,000 tons. Domestic competitors are Hengdian East Magnetic. According to the company's disclosure, Hengdian East Magnetic Wet Magnetic Tile is currently about 45,000 tons. Dragon Magnetic Technology is currently planned to reach 40,000 tons in 2022, 50,000 tons in 2023, and 60,000 tons in 2024.

The company's metal soft magnetic powder core is expected to be 5,000 tons, and 4,000 tons have been built. The iron oxygen soft magnetic powder core has been completed in the fourth quarter of 22 years. The expected scale is 6,000 tons, and 3,000 tons have been built.

6.5 Dongmu shares: Strategic layout soft magnetic base, powder metallurgical leader in the future

Powder metallurgical leader, the soft magnetic sector continues. The company is a global powder metallurgical giant and has the number one domestic market. Soft magnetic sectors have grown rapidly, mainly due to the continuous improvement of the prosperity in the photovoltaic and new energy vehicle industries. The company plans to build an annual output of 60,000 tons of soft magnetic material industry bases in Shanxi to further enhance the profitability of soft magnetic materials and strengthen the core competitiveness of the company's soft magnetic sector.

The capacity utilization rate of soft magnetic sector operates at a high level, and the construction capacity is accelerated. At present, the company's production capacity has a high capacity utilization rate, Koda has a annual production capacity of 40,000 tons, and the company has acquired all the equity of Koda, and the upstream raw material company Deqing Xinchen is expected to improve the profitability. Essence Shanxi Dongmu annual production capacity of 6,000 tons has been put into operation. The company is starting to build a 60,000 -ton soft magnetic material project in Shanxi. It will accelerate the construction of the project in the future.

6.6 Daytong Shares: Leaders of high -end soft magnetic materials, self -developed equipment technology to build a moat

Magnetic Materials Business: The company is the leader of high -end soft magnetic materials. The company's production capacity of iron oxygen soft magnetic materials and magnetic cores is second only to Japan's TDK. It is the second largest R & D and manufacturing base in the industry. The company has built the first domestic magnetic material automation production line to improve production efficiency and improve the quality and price competitiveness of the product as a whole.

6.7 Wanting Varling: Steaming Silicon Steel's private leader, integrated industrial chain to enjoy the advantages

Private orientation of silicon steel faucet and deeply cultivate integrated industrial chain. The company's orientation of silicon steel ranks third in the country, and the number of output in private manufacturing enterprises ranks first. In 2021, the company's transmission and distribution and control equipment revenue reached 845 million yuan, accounting for 45.23%of the company's total revenue. The company can produce electric transformers, box -type substation and sets of electrical equipment, and has formed a full -industrial chain coverage of the production of transformer production from the stem silicon steel.

The high -end fundraising project, the production capacity continues to be released. As the company raised 80,000 tons of Silicon Steel Silicon Steel gradually put into operation, it is expected that the company's ingredients silicon steel production capacity will reach 135,000 tons in 2023, and the actual output is expected to be 125,000 tons. In the second half of 2024, the import equipment is in place. For complete production, it is expected that the company's CGO product production capacity is 100,000 tons in 2024, the production capacity of HIB products is 65,000 tons, and the proportion of high -brand products has increased significantly.

6.8 Cloud Road Shares: A amorphous alloy leader, deep cultivation of high -performance soft magnetic materials

The non -crystal alloy belt produced by the company is mainly used in the transformer field. In the field of amorphous alloys, the company broke through key technologies of industrialization in 2012 and developed iron -based amorphous alloy thin bands with a width of 142mm; in the field of nanocrystalline alloy, the company produced by the company can reach 142mm. The thickness reaches 14 ~ 18 & micro; M, becoming the first company in China to realize the thickness of the thickness of 14 microns, which can meet the performance and size requirements of high -frequency magnetic devices with high power. At present, the technical achievements of the company's products have reached international or domestic advanced levels by identification or evaluation.

The performance of the 2022 Half of the 2022 Reports revealed that the company will be put into production lines in late June 22nd and late August, and the single line design capacity is 15,000 tons/year. Coupled with the original 60,000 -ton annual capacity, the current non -crystal alloy thin belt has 90,000 tons of annual capacity.

6.9 Moving new materials: MLCC demand expansion, nickel powder technology leading

The company has invested a lot of resources for the research and development and improvement of process technology, and has accumulated rich experience in the key production process. At present, it has entered the supply chain of well -known international customers such as Samsung. With the development of electronic component production technology and level, the trend of integration, miniaturization, and highly capacity of electronic components such as MLCC is becoming more and more obvious. This puts forward higher quality requirements for the production and development of metal powder materials. The company has built an industry -moat with its technical advantages.

The production capacity continues to expand, and its leading advantages are significant. The company's existing physical gas phase method has 92 metal powder production lines, of which 86 nickel original powder production lines, with an existing capacity of 1720 tons. The company's IPO fundraising amount is used in the relocation of the Ningbo plant, the expansion of the Suqian plant area, the construction of the R & D center, and the second -generation gas phase grading project to expand the production capacity and improve the process. The company's profitability is expected to continue to increase.

6.10 Yue'an New Material: Fine powder technology leads, cost advantage builds the strongest moat

The company has two major products. First, the company's current advantage is a large -scale cymbal iron powder. The technology is simple. There are two main application areas in the base iron powder, one of which is precision, and the second largest field is soft magnetic. The form of a product is electronic components. It used to be used in consumer electronics and is now gradually applied to cars. These two major areas account for 70%of all applications, and other areas include coatings and microwave absorption.

The second largest product is the atomized alloy powder that the company begins around 2010. It mainly uses a physical method to heat the raw material to the melting state, and use high -pressure water mist to break it into powder. Because atomized alloy powder has a certain amount of corrosion resistance, it is generally used as precision through powder molding, which is mainly used in the consumer electronics field; followed by the field of soft magnetic magnetic fields to do inductance.

In terms of production capacity, the company's current iron powder capacity is about 5,000 tons. The 6000 -ton project is at the end of the closing. After the application of the trial production, it will apply for acceptance. It is expected to be basically completed in the second quarter of 2023. The original plan was to invest 2,000 tons of iron powder output each year. The atomizing alloy powder has gradually invested in part of the production capacity in the second half of 2022, and some of them have a greater degree of correlation with consumer electronics. The overall planning capacity of the company is 4,000 tons and 2,000 tons of coarse powder. The remaining 2,000 tons will plan the production capacity to start production capacity according to the situation of this year's downstream market.

& nbsp;

* Reprinted from the Ningbo.com of China/China, please contact deletion if there is any infringement

BAIQIDA INTELLIGENT TECHNOLOGY (NINGBO) CO.,LTD.

? Tel: 0086-574-88750558

Wechat: coolfiger

Add: No.108 Xinghai Road, Binhai New District, Fenghua District, Ningbo City

Fax: 0086-574-88749378